Australian Grapes in China 2023 – Optimism and Caution

23 March 2023

We visited wholesale fruit markets in Shanghai, Guangzhou and Beijing over the past two weeks to meet fruit importers and discuss prospects for Australian grapes in China this season.

We believe that demand for Australian grapes may be reasonable this year, but longer term the South American grape growers and Chinese year-round supply will present even more competition.

Key observations:

China has bounced back well from COVID and like Australia there has been a consumer bounce. However, many consumers are still looking for value in the face of economic uncertainty.

Overall Trade Returning. Shanghai Huizhan market, Guangzhou Jiangnan market and Beijing Xinfadi Market are returning to more normal levels of trade after the pandemic with sales of grapes and stonefruit (particularly Chilean sugar plums) prominent now that Chile cherries are finished for the season. Some traders on the market floor in Beijing said trade was slow when we visited, with a lack of buyers. Very good quality grapes have been selling for good prices, though there are still relatively few buyers that can afford some of the new varieties.

Picture: Shanghai Huizhan Trading Floor, 2 March

Australian Grapes. Australian air freighted grapes and early season sea freighted crimson are quite widely observed in all markets. Very good quality crisp grapes, such as Sweet Globe, have been getting good prices but poorer quality softer fruit was severely discounted. Some Chinese importers are expecting the Australian Crimson season to be reasonably good with traders receiving reports that the quality is good. Australian crimson and sweet globe we saw in the market was very good – sweet and crisp. There will be a market, with regular Chinese consumers, for medium priced quality crimson and traders say there is still differentiation in the market with South American grapes.

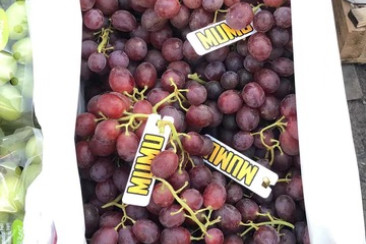

Pictures: Clockwise from Top Left; Australian grape stack Huizhan: Boxes of Australian Sweet Globe and Ralli on Huizhan Market Floor; Grape Stack Beijing Xinfadi Market and Australian Crimson ( left) (RMB26.8/500Gr (AUD 11.60/Kg) and Peru Sweet Globe (bottom right) on display at a fruit store in Guangzhou, March 2023

Peruvian grapes. Peruvian grapes are now coming to the end of their production season. Early season supply was affected by weather and supply disruptions. Traders said the taste of early season fruit, before Chinese New Year, was not so sweet. Noticeable in Shanghai Huizhan market, over previous years, was the increasing supply of newer green varieties – particularly Autumn Crisp and Sweet Globe – which have both taken off in China and now make up as much as 50% of Peruvian exports to China, displacing red globe. We think that these newer seedless grapes from South America pose a significant challenge to Australia going forward as volumes ramp up and prices become more competitive – they certainly meet Chinese requirements of crispness and sweetness. (Interestingly however, one trader told us that some of the other newer varieties, such as Candy Heart, have great taste but have a harder time growing market share as they are prone to shatter, do not have uniform berry size and were too costly for most retailers).

Picture: Peruvian Sweet Globe on Display at Huizhan Market, Shanghai and in a retail chain

South Africa. We have seen very little South African grapes on the market this season and saw none in Huizhan and only small quantities in Beijing and Guangzhou markets. Traders say this is due to low early season supply because of climate issues and high shipping costs to China. South Africa appear to be focusing their exports on Europe this season.

Chile. Chilean Air freighted grapes we saw in Huizhan market were good quality and selling well. Importers said that a heatwave in Chile had reduced some early season production. Export statistics indicate that up to Week 10 that 849 containers of grapes have been sent to China compared to 1128 for the same time last year but it remains to be seen how many will be sent into China. A report on Fruitnet.com said that so far 75% of Chilean grape exports this season had been sent to North America and 6% to China and Hong Kong. Sea containers of Chilean grapes are starting to arrive in Guangzhou, with two vessels arriving in week 11, containing significant quantities of Sweet Globe and Sable and causing a significant drop in prices. One trader in Beijing said some Chilean grape vines were being pulled to plant other fruits.

Picture: Airfreighted Chilean Sweet Sapphire and Sweet Globe in Huizhan Market Shanghai and Sweet Globe and Sable on Display at High end Supermarket in Beijing.

Chinese Supply. China is improving grape production all the time with Crimson now grown almost year-round in various provinces and in glass houses and new varieties being introduced. A newly marketed variety, Sun Rose, is currently retailing widely at around RMB50 per 500g (AUD 21/kg) in a regular fruit shops and double that in high end supermarkets. One trader said that the longer season supply of Chinese grapes will represent competition to all supply countries going forward.

Pictures: Chinese grapes at fruit stores. Chinese Crimson in Beijing (left)(RMB 17.9/500G) and ‘Sun Rose’ grapes (RMB 49.8/500Gr) in Shanghai, March 2023

Payment/Supply Terms. One of the main reasons South American suppliers completely dominate and are growing are their attractive supply terms. Most trades between large Chilean or Peruvian suppliers and Chinese importers are now on consignment, meaning the buyer has limited risk on one trade. However, the buyer is still required overall to deliver good returns to the supplier otherwise they will lose the ongoing supply. One trader told us that most large Chinese fruit importers do not buy grapes from Australia now because of past losses.

If you need assistance in China we are ready to provide support by: Introducing Key Buyers; Registering Trade Marks and Visiting Chinese Markets or Stores to Inspect your Fruit please contact us at email: pwebley@sinoaccess.com.au