Australian Grape Prospects in China 2021

10 February 2021

In 2020/21 table grape production of China will be about is 11 million tons, with growing production reflecting constant improvement of orchard management and storage technology (USDA). Domestic grapes now have a longer supply period than before with Crimson grapes from Yunnan still widely available in stores, despite the major growing period being August to October.

Photos,: Chinese Crimson and Jufeng Grapes displayed at Fruit Stores in Nanjing China, January 2021

The retail price for Yunnan Crimson is not cheap at the moment - about RMB30-36 (A$6.25-7.50) per kg on a recent survey. Chinese grape suppliers now pay attention to branding and boxes readily display the brand. Another report in the Chinese Fruit press suggests that Chinese domestic fruit quality is improving and this is recognised by consumers.

Many importers have Australian grapes, particularly Crimson, as a key part of their offer to customers in the period March to May when other imported fruits have low volume. Currently the market is dominated by supply of Chilean cherries and it is still early season for Australian grapes and volume is small. The peak season for Australian grapes always occurs after Chinese New Year when Chilean cherries have declined, though this season’s extraordinary cherry import volume, and still unsold stock, will lead cherry sales continuing into March.

Jiangnan market in Guangzhou readily accepts Australian Crimson and this will continue. However, talking to traders there, the following unique factors may affect purchases this season:

COVID

Because of the Pandemic importers will be very cautious in buying all imported fruit, including grapes. The Government is encouraging people to stay where they are for Chinese New Year. If people travel they are subject to quarantine on arrival and return. COVID has also reduced peoples’ shopping frequency. After 8 March, when travel restrictions are slated to ease, the market for imported fruit will likely be better.

Political relationships

According to importers, good political relationships drive good trade relationships.

Less spending

People may buy less imported fruit this season because of less job and income security brought on by COVID. As a result, Importers will be more cautious on the volumes they import.

Cherry Market Overhang

Chinese importers of cherries from Chile are dealing with the recent twin factors of COVID being found in cherry packaging, causing a drop in consumer demand, and too much supply (greater than 10,000 containers for the season). The need to reconcile receipts, remit end of season funds back to growers and potential financial losses will complicate the overall fruit import market through March.

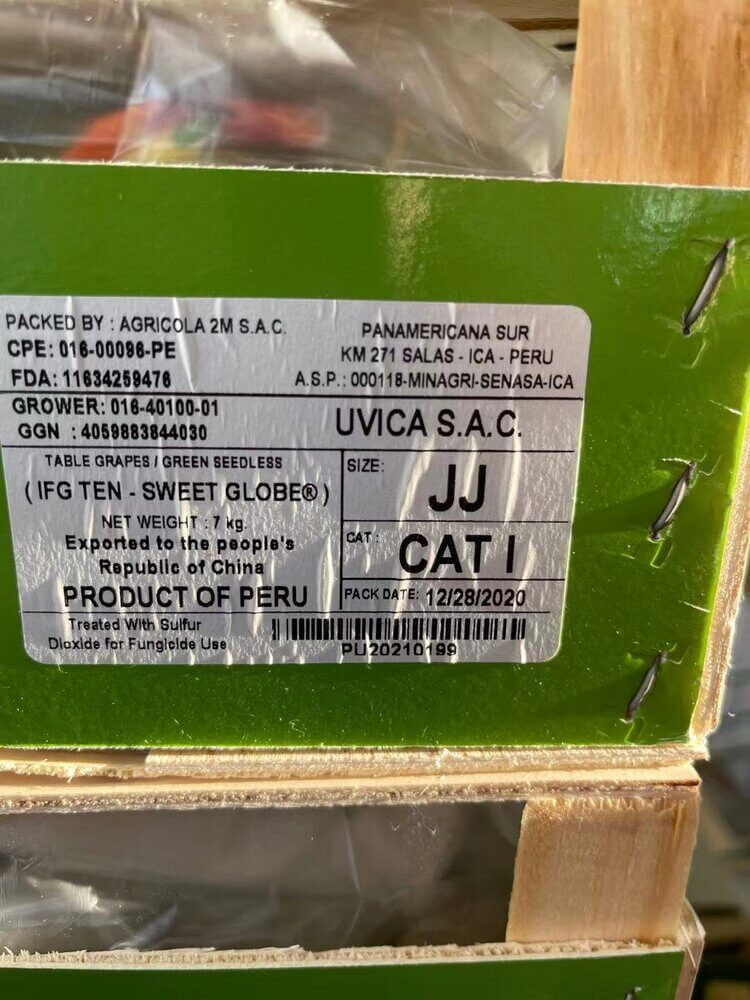

International Grape Competition

This year is seeing increased early season supply of new grape varieties from Peru, particularly Sweet Globe, which have met with strong market demand. Wholesale prices for Peruvian Sweet Globe in Jiangnan market have been very strong in the past week – double prices for Red Globe. New varieties are likely to replace Red Globe as the major grape types from South America in coming years.

Domestic fruit competition

The market for Australian grapes will be better when domestic grape supply from Yunnan ends in March.

Photo: Peruvian Sweet Globe in China, February 2021.